How to Improve Customer Billing

Курсы обучения форекс forex с нуля

29/05/2023Inpatient Alcohol Rehab & Detox Treatment Centers Near Me

31/05/2023

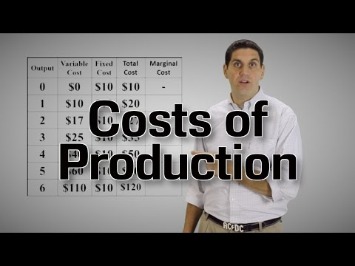

If you’re a subscription-based business or offer specific services for a monthly fee, then this type of billing is likely the best option for you. With cloud accounting software, you can completely automate the process, and set up recurring invoices so they get sent automatically at a fixed interval of time. On the other hand, collection is responsible for pursuing payments from customers who have failed to pay their bills. This can involve contacting them directly, issuing legal threats, or taking other measures to recover the money owed. For project-based work, a fixed-rate or project-based billing method may be suitable.

One small change causes the entire format to scramble, and you end up wasting your office hours creating invoices, rather than managing your business. More specifically, an invoice includes the name of the product a buyer purchases, the products’ pricing and payment terms, and the buyer and seller contact information. Depending on the customer relationship you have, you might offer net-15 or net-30 terms, requiring what does “lien amount” in the sbi mean your customers to pay within 15 or 30 days. Also, don’t just post the terms — make sure you include an actual due date. Late payments, inconsistent records and unhappy customers are just a few of the potential consequences. The invoice must also be formatted in a way that is easy for the customer to understand.

For businesses, one-time billing helps to reduce the complexity of managing ongoing subscriptions and payments. It also ensures that the business receives payment upfront, reducing the risk of non-payment or late payments. The second step in the billing process is to send the invoice to the customer. Once it has been created, the invoice must be sent to the customer in a timely manner.

Plans for every kind of business

- So, in simpler words, the billing cycle refers to the interval between the last billing date and the current billing date for any sale of goods and services.

- It offers a no-fuss interface to precisely track the hours both you and your team invest toward a client.

- Using templates, you can generate a clean and effective invoice in just a few minutes.

- Client billing is the process of charging clients for goods or services provided by a business.

- The purpose of billing is to request payment for the products or services rendered and to ensure timely payment from customers or clients.

In accounting, billing is a crucial component of the revenue cycle and a key factor in ensuring business success. It involves creating and sending invoices that are clear, concise, and professional to customers or clients, with the ultimate goal of generating revenue. If you’re billing at an hourly rate, the ClickUp Time Tracking tool agile methodologies: kanban vs scrum advantages and disadvantages can help you collect payments with greater accuracy. It offers a no-fuss interface to precisely track the hours both you and your team invest toward a client.

There’s no need to worry about writing down a subject line, email body message, and manually attaching the invoice pdf file – invoicing software does everything for you. The traditional postal office method isn’t very convenient, as it can be slow, time-consuming, and unnecessarily costly. The extra expense of paper, ink, and postage, can be easily avoided by sending an email attachment instead. Instead, it’s better to automate your follow-ups and reminders as much as possible, so you don’t even have to think about the process. You should also be ready to escalate gradually if you continue to get ignored. Speaking of intuitive design, it’s important to shape your invoices so they’re clear and easy to understand.

Project management tools are all-in-one solutions that can simplify many aspects of billing by unifying diverse financial processes within a centralized platform. For instance, tools such as ClickUp not only offer a comprehensive CRM solution but also provide time tracking capabilities, client overviews, and automated reminders. On top of that, they come with numerous templates that will make your billing process more manageable. This type of billing method is popular in cases with a fixed fee or a one-time service. The payment is made when a service has been provided, or a product or project is delivered.

Both Word and Excel provide a gallery of templates, where you can type “invoice” in the search box to get access to the invoice templates. Each step is vital to ensure that cash is collected from customers promptly. Several factors go into creating an accurate invoice, such as ensuring that the correct items are included, calculating the correct totals, and applying for any discounts or credits. Make sure to pick a method that fits your services and makes your clients happy.

Bill Clients with Confidence: Explore ClickUp

Since your billing software serves as the central hub of your billing process, it has the potential to improve everything, from billing consistency to customer satisfaction. Continue following up with additional surveys to see how your customers’ attitudes change in response to your improvements. Order-to-cash (OTC) can be a time-consuming and arduous process when departments are not properly communicating with each other. Therefore, companies should consider integrating CPQ with their billing software to net cash flow formula work more efficiently and avoid these issues.

What Is Billing in Accounting – Billing Process Explained

Give your customers multiple options for how to pay and make those options as convenient as possible. If you’re sending bills digitally (as you should), you should have options for customers to pay with a single click. Conventional payments, like credit card and check, are a given, but you might consider offering alternative forms of payment as well, like cryptocurrency.

Overall, the billing process is an essential part of any company’s operations and revenue growth. A billing software is a computer program designed to help businesses automate their billing and invoicing process. It allows companies to generate and send invoices, track payments, and manage customer accounts in an organized and efficient manner. Additionally, the software can be used for a variety of industries and can be customized to fit the specific needs of a business. To leverage CPQ and billing software for an efficient order-to-cash process, it is important first to understand the benefits of using these tools.